If I spent what this divorce cost me on hookers, at least I would have gotten laid once in a while.

I managed to get a whole $25 in royalties during the year 2022 for a technical book I wrote in 2003. Not bad.

Never got a royalty statement for 2021, though, because it was sent to my previous residence and I only got the 2022 one because I finally put in a request to have my mail forwarded back in November.

Now the question is: was the ex stupid enough to have cashed that check or not.

Between an estimated tax payment or two and changing my withholding slightly, I should hopefully not owe the IRS too much money at the end of 2023…

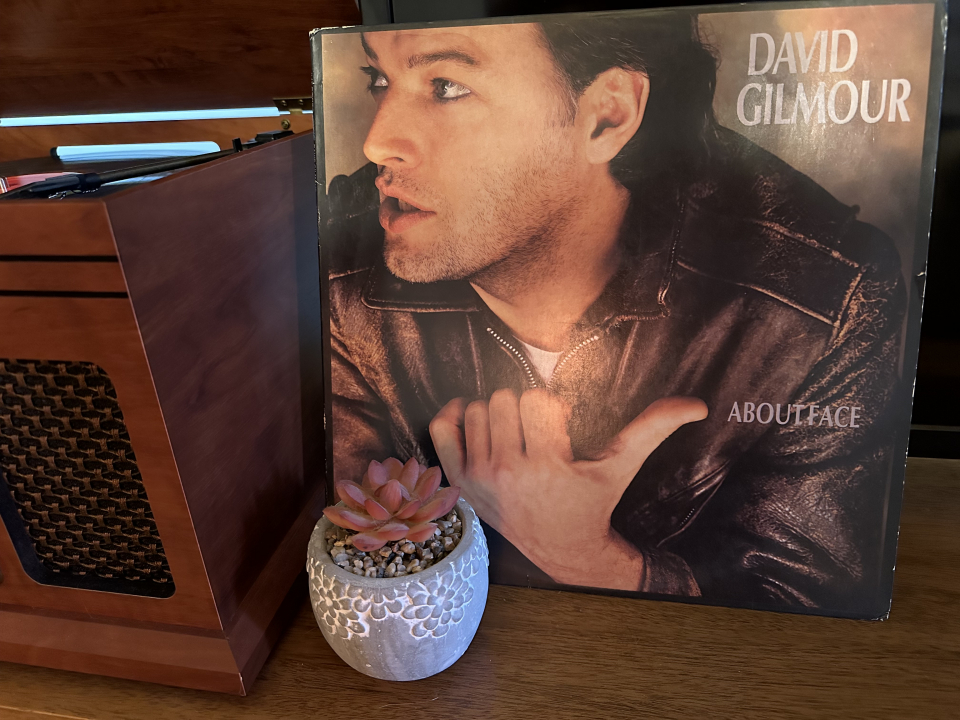

@matigo my music collection was one of the few things I wanted from the ex (and got). Didn’t start collecting vinyl until last year when I finally got settled in Tennessee. Needless to say…my music collection is important (to me anyway).

When all’s said and done the ending will come from out of the blue. #nowplaying